The Most Stable Coin in Crypto: Top Picks

Note: This post may contain affiliate links, and we may earn a commission (with No additional cost for you) if you purchase via our link. See our disclosure for more info. The gold and crypto world is constantly changing. This is not financial, investment, legal, or professional advice. So, please verify the information on the gold and cryptocurrency provider’s websites.

When it comes to stablecoins, Tether (USDT) is the heavyweight champion. It's got liquidity like no other, yet trust issues loom large. Then there's USD Coin (USDC) with its cozy regulatory blanket and full audits—seems legit. DAI takes a more DIY approach, decentralizing the whole deal. And if gold's your thing, Pax Gold (PAXG) offers a shiny hedge against inflation. Curious about the pros and cons of these digital dollar stand-ins? Stick around; there's more to unpack!

In the chaotic world of cryptocurrency, stablecoins are like that reliable friend who shows up on time—rare, but appreciated. Among them, Tether (USDT) stands out, reigning supreme with unmatched liquidity and a first-mover advantage. Backed by U.S. dollar reserves, it's the go-to option for many traders, despite its transparency issues. It's a love-hate relationship, really.

In the wild world of crypto, Tether (USDT) shines as the reliable choice, balancing liquidity with a touch of controversy.

Enter USD Coin (USDC), the poster child of regulatory compliance. Fully audited and backed by the dollar in regulated institutions, it's like the straight-A student in a class of rebels. Regulation varies among stablecoins, impacting their overall stability and trustworthiness.

Then, there's DAI, the decentralized darling. It's crypto-backed and governed by MakerDAO, offering a unique twist for those who prefer autonomy over the traditional centralized options. But hold your horses; with autonomy comes risk.

Centralized stablecoins like USDT and USDC might offer liquidity, but they also carry the burden of counterparty risk. If the backing institution flops, good luck.

Pax Gold (PAXG) deserves a shout-out too. Backed by physical gold, it serves as an inflation hedge. Who doesn't want a little shiny stuff when the market gets rocky?

PayPal USD (PYUSD) is also creeping in, gaining traction through PayPal's growing crypto services. It's like the new kid on the block who suddenly becomes popular. These coins provide essential store of value in the volatile cryptocurrency landscape, serving as a bridge between traditional and digital finance.

But let's not sugarcoat it; stablecoins come with their own set of challenges. Centralization is a double-edged sword. Sure, they're easy to trade, but the looming threat of regulatory scrutiny and market volatility is always there.

And let's face it, algorithmic failures—though rare—can throw a wrench in the works for the less-collateralized models.

In a world where crypto can shift on a dime, stablecoins attempt to provide a semblance of stability. They're not foolproof, but they're certainly a better option than jumping into the wild unknown.

Frequently Asked Questions

How Do Stablecoins Maintain Their Value Stability?

Stablecoins cling to value stability through various methods.

Some back themselves with fiat reserves—think cash in the bank. Others over-collateralize with crypto to cushion against wild price swings.

Then there are those that try to tie their worth to commodities like gold.

Traders jump in to exploit price differences, keeping things in check.

But beware: if trust erodes, stability can go right out the window. Just ask TerraUSD.

Are Stablecoins Regulated by Any Government Authorities?

Yes, stablecoins are under the watchful eyes of regulators.

In the U.S., various bills like the GENIUS Act and Waters Act propose different oversight methods. They're not just floating around with no rules!

There are reserve mandates, strict compliance measures, and even penalties for noncompliance.

The government is clearly saying, “We're not letting this be the Wild West.”

Can Stablecoins Be Used for International Transactions?

Absolutely, stablecoins can be a game-changer for international transactions.

They're quick, cheaper, and less of a hassle than traditional methods. No more waiting days for wire transfers or paying ridiculous fees. Plus, they're all about transparency—thanks, blockchain!

But, let's be real, there are hurdles. Regulatory issues and adoption gaps are still a thing.

Still, for many, stablecoins are the future of cross-border cash flow. Just don't forget—nothing's perfect.

What Risks Are Associated With Using Stablecoins?

Using stablecoins? Buckle up.

They come with market risks, like sudden value crashes or liquidity issues. Runs on them can lead to chaotic sell-offs, so good luck with that.

Then there's the cybersecurity mess—hackers love unregulated spaces.

Oh, and regulatory headaches? Yeah, they're piling up.

Plus, illicit activity lurks in the shadows, making tracking transactions a nightmare.

How Do I Store My Stablecoins Securely?

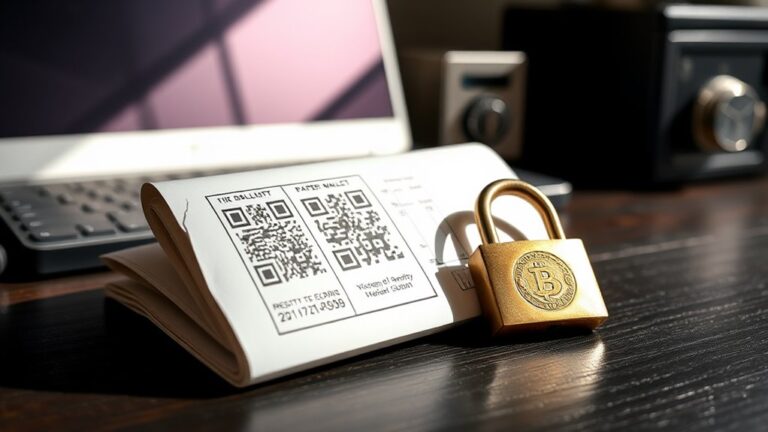

Storing stablecoins securely? It's not rocket science, but it's close.

Hardware wallets are the gold standard—think Ledger or Trezor. Offline and safe, they keep your private keys well-protected.

Paper wallets? Sure, if you enjoy living dangerously. Multi-signature wallets add extra security but come with the headache of coordinating approvals.

Just remember, security is about being smart, not just lucky. So, don't be that person who forgets where they stashed their coins!

One Comment