Why Hedge Crypto Risk With Gold Investments?

Note: This post may contain affiliate links, and we may earn a commission (with No additional cost for you) if you purchase via our link. See our disclosure for more info. The gold and crypto world is constantly changing. This is not financial, investment, legal, or professional advice. So, please verify the information on the gold and cryptocurrency provider’s websites.

When you dive into cryptocurrency investing, you face the tricky task of managing risk in this unstable market. While the potential for high returns is alluring, the unpredictability can be unnerving. That's where gold investments come into play. Including this precious metal in your portfolio does more than diversify it. It can also help shield your wealth from the volatile nature of crypto. But why gold specifically? And how can you effectively balance these seemingly disparate assets? The key is in knowing how cryptocurrencies and gold relate. This pairing offers unique benefits.

Key Takeaways

- Gold's historical safe-haven status provides stability during economic uncertainty, contrasting with cryptocurrency volatility.

- Weak correlation between gold and cryptocurrencies offers effective portfolio diversification benefits.

- Gold serves as an inflation hedge, maintaining value during periods of economic instability.

- Gold's negative correlation with the S&P 500 during market declines (-0.134) contrasts with Bitcoin's positive correlation (0.258).

- Gold receives return and volatility spillovers from cryptocurrencies, enhancing its protective role against crypto market unpredictability.

Understanding Cryptocurrency Market Volatility

Three key factors contribute to cryptocurrency market volatility: correlation with traditional markets, sensitivity to external events, and regulatory uncertainty. Understanding these factors is essential for investors looking to hedge their crypto risk.

Cryptocurrency markets, particularly Bitcoin, have shown significant volatility during market crashes. Data reveals that Bitcoin's correlation with the S&P 500 averages 0.258 during major downturns, indicating increased risk. In fact, Bitcoin's correlation with equities during five notable S&P 500 declines ranged from 0.814 to 0.588, demonstrating its tendency to act more like a risky asset than a hedge.

In contrast, gold has proven to be a reliable safe haven during times of financial distress. The average correlation between gold and the S&P 500 during market crashes is -0.134, highlighting its effectiveness as a hedge against market volatility.

External events, such as the COVID-19 pandemic, have also impacted cryptocurrency markets. Bitcoin showed higher variances in the short to medium term during this period, reflecting heightened market instability.

Additionally, regulatory scrutiny and market sentiment contribute to the unpredictability of cryptocurrencies, further emphasizing the need for a stable hedge like gold in your investment portfolio.

Gold's Historical Safe-Haven Status

While cryptocurrencies have shown volatility and correlation with traditional markets during downturns, gold has consistently proven its worth as a safe-haven asset. Throughout history, gold has demonstrated resilience in various economic conditions, making it a reliable hedge against market volatility. Its performance during financial crises, such as the 2008 Global Financial Crisis, highlights its effectiveness as a protective asset.

Gold's appeal as a safe-haven investment stems from several key factors:

- Stable positive correlation with market indices during periods of uncertainty

- Increased demand during inflationary periods, boosting its prices

- Diverse demand sources, including industrial, jewelry, and central bank purchases

Unlike cryptocurrencies, which have exhibited increased correlation with equities during market downturns, gold maintains its status as a protective asset. This makes it an attractive option for investors seeking to hedge against crypto risk.

Gold's long-standing reputation and empirical evidence supporting its hedge and safe-haven properties make it a strategic portfolio addition. By incorporating gold into your investment strategy, you can potentially mitigate the risks associated with cryptocurrency volatility and enhance overall portfolio stability.

Portfolio Diversification Benefits

Considering the volatile nature of cryptocurrencies, incorporating gold into your investment portfolio can offer significant diversification benefits. Gold's historical safe-haven properties make it an effective hedge against market volatility, particularly during financial crises. Unlike cryptocurrencies, which often correlate with equities during downturns, gold maintains a weak correlation with both stocks and digital assets.

Key portfolio diversification benefits of including gold:

- Risk reduction: Gold's stable positive correlation with cryptocurrency uncertainty indices helps mitigate crypto risk.

- Inflation hedge: Gold retains value during inflationary periods, protecting your portfolio from economic instability.

- Improved diversification: Gold's weak correlation with cryptocurrencies reduces overall portfolio risk during market stress.

Research using the Dynamic Conditional Correlation GARCH model shows that gold consistently receives return and volatility spillovers from cryptocurrencies. This enhances its role as a protective asset against crypto unpredictability.

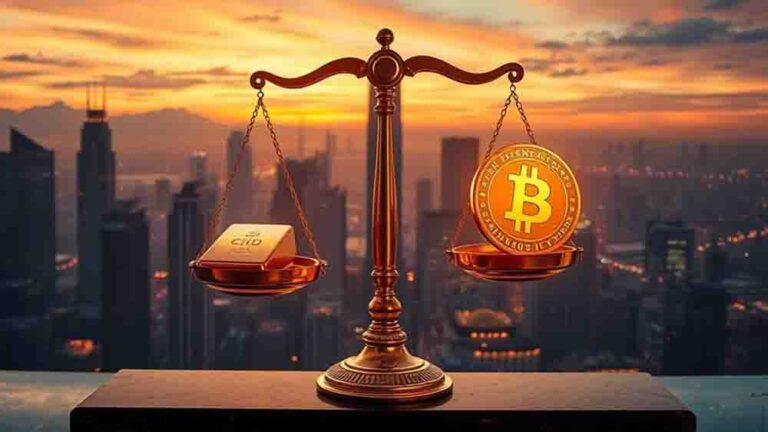

Correlation Between Gold and Crypto

When considering gold as a hedge for crypto investments, you'll find that these two assets often move in opposite directions.

Historical data reveals a stable negative correlation between gold and cryptocurrency, especially during market downturns.

This inverse relationship becomes particularly evident during periods of market stress, with gold maintaining its status as a safe haven while cryptocurrencies may align more closely with equities.

Inverse Relationship Dynamics

Delving into the inverse relationship dynamics between gold and cryptocurrencies reveals a stark contrast in their behavior during market turbulence. When equity markets experience downturns, gold often demonstrates its role as a safe haven asset, maintaining a stable negative correlation with stocks.

In contrast, Bitcoin and other cryptocurrencies tend to increase their correlation with equities during periods of market stress. This divergence becomes particularly evident when examining historical data:

- During five significant S&P 500 declines, gold showed an average correlation of -0.134 with the index.

- Bitcoin, on the other hand, exhibited a positive average correlation of 0.258 during the same crashes.

- The correlation between Bitcoin and gold remains weak, at 0.057 in rising markets and only slightly higher at 0.064 during market crashes.

These findings underscore gold's effectiveness as a hedge against stock market volatility, while Bitcoin often behaves more like a risky asset during financial crises.

Recent events, such as the COVID-19 pandemic and the Russo-Ukrainian War, have further reinforced gold's status as a reliable safe haven, whereas cryptocurrencies have demonstrated increased correlations with equity markets, highlighting their limitations as effective hedging tools.

Market Stress Correlations

The correlation between gold and cryptocurrencies during market stress periods offers valuable insights for investors seeking to hedge their crypto risk. Gold has consistently demonstrated its safe-haven status, exhibiting a stable positive correlation with cryptocurrency uncertainty indices. This relationship highlights gold's reliability as a protective asset during times of crypto market turbulence.

When comparing gold's hedging capabilities to those of Bitcoin, significant differences emerge:

- During S&P 500 declines, gold maintained a negative correlation (-0.134), while Bitcoin showed a positive correlation (0.258).

- Gold consistently receives return and volatility spillovers, enhancing its effectiveness as a hedge against crypto risk.

- Bitcoin's correlation with gold remains close to zero, limiting its ability to hedge against equity risk.

The Dynamic Conditional Correlation GARCH model analysis further supports gold's role in portfolio diversification. During market crises, gold serves as a protective asset, while Bitcoin often behaves more like a risky asset.

This contrast reinforces the importance of including gold in your investment strategy to diversify against crypto market stress and minimize overall portfolio risk.

Implementing a Hedging Strategy

To implement an effective hedging strategy with gold and cryptocurrencies, you'll need to evaluate portfolio allocation strategies, timing your market entry, and monitoring correlation shifts.

Start by determining the ideal percentage of your portfolio to allocate to gold based on your risk tolerance and investment goals.

You should then carefully time your entry into the gold market, potentially increasing your position when cryptocurrency volatility rises or during periods of economic uncertainty.

Regularly monitor the correlation between gold and cryptocurrencies, adjusting your allocation as needed to maintain the desired level of protection against crypto market fluctuations.

Portfolio Allocation Strategies

Implementing a hedging strategy with gold in your crypto portfolio requires careful consideration of allocation percentages. By diversifying your investments to include gold, you can mitigate the risks associated with cryptocurrency volatility. Gold has historically demonstrated stable hedging properties during financial crises, making it a reliable safe-haven asset.

When determining your portfolio allocation, consider the following factors:

- Your risk tolerance

- The current market conditions

- Your investment goals and time horizon

Studies show that gold exhibits a stable positive correlation with cryptocurrency uncertainty indices, emphasizing its role as a protective asset. During market downturns, gold often maintains its value while cryptocurrencies may experience increased correlations with equities. This reinforces the rationale for including gold as a hedge against crypto risk.

To effectively implement your hedging strategy, consider allocating a portion of your portfolio to gold based on your individual circumstances. The Dynamic Conditional Correlation GARCH model analysis supports gold's ability to receive return and volatility spillovers, further highlighting its importance in mixed portfolios.

Timing Market Entry

Timing your market entry is a critical aspect of implementing a successful hedging strategy with gold investments for your crypto portfolio.

When considering how to hedge cryptocurrency risk, pay attention to periods of economic policy uncertainty and market volatility. Research shows that gold's safe-haven properties become particularly valuable during these times, providing a buffer against potential crypto losses.

To optimize your market entry:

- Monitor geopolitical crises: Historical data demonstrates gold's outperformance during events like the COVID-19 pandemic and Russo-Ukrainian War.

- Watch for increased correlation between crypto and equity markets: This signals a prime opportunity to diversify with gold.

- Utilize the Dynamic Conditional Correlation GARCH model: This analysis tool can help you identify gold's role as a net receiver of return and volatility spillovers.

Monitoring Correlation Shifts

Monitoring correlation shifts is essential when implementing a hedging strategy with gold for your crypto portfolio. As market conditions change, the relationship between gold and cryptocurrencies can fluctuate, affecting your hedge's effectiveness.

Keep an eye on how gold's correlation with crypto uncertainty indices remains consistently positive, indicating its reliability as a hedge against crypto volatility.

During market downturns, gold's negative correlation with stocks (-0.134 average) compared to Bitcoin's positive correlation (0.258 average) underscores its value as a safe haven.

You'll want to observe how these correlations shift, especially during:

- Geopolitical crises

- Economic upheavals

- Crypto market turbulence

Gold's hedging effectiveness tends to increase during periods of high uncertainty, such as the COVID-19 pandemic or the Russo-Ukrainian War.

By contrast, Bitcoin often exhibits higher volatility and correlation with equities during these times.

Regularly assess the weak correlation between gold and Bitcoin (around 0.057 in rising markets) to guarantee your investment strategy maintains a well-diversified portfolio that can weather various market conditions.

This ongoing monitoring will help you adjust your hedge ratio and maintain ideal protection against cryptocurrency risks.

Regulatory Considerations and Future Outlook

As the cryptocurrency landscape evolves, regulatory considerations play an increasingly vital role in shaping the future of digital assets and their relationship with traditional hedges like gold.

Regulatory frameworks surrounding cryptocurrencies are still developing, with governments and financial authorities focusing on investor protection and market stability. This ongoing scrutiny can influence crypto market volatility, making gold an attractive option for hedging strategies.

When considering portfolio optimization against crypto risk, it's important to understand the interplay between cryptocurrency regulations and traditional assets like gold. Future regulatory developments, including potential taxation and reporting requirements, may impact investor sentiment and drive demand for stable assets.

As institutional adoption of cryptocurrencies grows, regulatory clarity could lead to increased market maturity. This may reinforce gold's role as a stable hedge during tumultuous periods.

To make informed decisions:

- Monitor ongoing research on gold-crypto correlations under different regulatory environments

- Stay updated on evolving compliance and legal frameworks

- Consider gold's potential as a hedge against regulatory uncertainty in the crypto space

Frequently Asked Questions

Is Gold a Hedge Against Currency Risk?

Yes, gold is an effective hedge against currency risk. You can rely on its historical stability during periods of inflation and currency devaluation.

Unlike volatile cryptocurrencies, gold maintains its value and often appreciates when fiat currencies weaken. It's shown an inverse correlation with inflation, preserving purchasing power.

During financial crises, gold has consistently outperformed other assets. Central banks and investors turn to gold for safety in economic downturns, underscoring its enduring appeal as a hedge against currency risks.

Why Is Gold Used as a Hedge?

You'll find that gold is used as a hedge for several compelling reasons.

It's historically proven to maintain value during economic downturns and high inflation periods. Gold's negative correlation with equity markets provides protection during financial crises.

Its diverse demand sources, including jewelry and central bank reserves, contribute to its stability. Unlike cryptocurrencies, gold consistently performs as a protective asset during market turmoil.

This unique combination of traits makes gold an effective tool for portfolio diversification and risk management.

Does Gold Affect Crypto?

Gold does affect crypto, but indirectly.

You'll find that gold's stability often contrasts with crypto's volatility. When crypto markets are uncertain, investors may turn to gold as a safe haven, potentially impacting crypto prices.

Gold's negative correlation with equities during market downturns can also influence crypto, especially when Bitcoin's correlation with stocks increases.

Do Hedge Funds Invest in Gold?

Yes, hedge funds do invest in gold. You'll find that many funds include gold in their portfolios as a risk management strategy.

They often use gold to:

- Diversify their investments

- Protect against market volatility

- Hedge against economic uncertainty

Hedge funds typically gain gold exposure through:

- Gold-backed ETFs

- Physical gold holdings

- Gold mining stocks

About 30% of hedge funds incorporate gold in their strategies.

During crises, like the COVID-19 pandemic, hedge funds increased their gold investments considerably, contributing to the metal's price rise in 2020.

Conclusion

You've learned why hedging crypto risk with gold investments is a smart move. By balancing your portfolio with gold, you're protecting yourself against crypto's volatility while leveraging gold's stability. Remember, diversification is key. As you navigate the crypto market's ups and downs, gold can serve as your financial anchor. Consider implementing this strategy, but always do your research and consult with financial professionals before making investment decisions. Stay informed, stay diversified, and you'll be better prepared for whatever the market throws your way.